Earlier on this blog I set out how PARD is blatantly violating both state and local law not only by its continuing refusal to implement the Austin Perpetual Care Trust Fund, but also by its mishandling of the funds already entrusted to the City of Austin by citizens who assumed that those monies would be used to solely for the perpetual care of their loved ones' graves. To summarize, under state law, a municipality that owns, or operates a cemetery may enact an ordinance creating a trust for the perpetual maintenance of graves in that cemetery, acting as the permanent trustee for that fund. This includes adopting rules permitting the trust to receive a gift or grant for permanent maintenance of a specific grave or burial lot. Such funds are to be invested in interest-bearing bonds or governmental securities. The resulting revenue may be used only for the maintenance and care of the grave for which the funds are donated; if the income is more than the amount necessary to maintain the gravesite, then the excess may be used to beautify the cemetery where the gravesite is located. The City of Austin implemented such a trust pursuant to the Texas statutes. As of 1992, Section 10-1-11 of the Austin Code of Ordinances (Code) establishes the City of Austin Perpetual Care Trust Fund (PCTF) to: assure the perpetual maintenance of the city cemeteries; invest and reinvest money in trust accounts in the trust fund; and apply the income earned by the PCTF that is in excess of the amount necessary to maintain the individual cemetery lots or graves to the beautification of the city cemeteries generally.

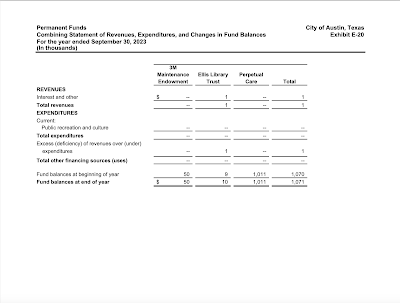

Despite the fact that PCTF has been part of the City Code for some 30 years, PARD has utterly failed to comply with both the city ordinance and state law regarding the PCTF. PARD has willfully failed to implement the ordinance; has illegally prevented citizens from contributing to the PCTF; and, from 1991 through 2014, PARD has spent over $2 million in income from PCTF, but there is no accounting as to what the funds were used for and no evidence that the expenditures were to maintain specific gravesites and cemeteries (the only expenditures permitted under both state and local law). Further, even though under both state and local law, the PCTF is supposed to be invested in "interest-bearing bonds or governmental securities,” allegedly there has been no reported revenue from 2016 through 2023, despite the fact that there is currently $1,011,000 million in the fund. Finally, PARD not only has continued to violate state and local law regarding PCTF, it has surreptitiously sought to dissolve the PCTF to give it free access to spend the remaining principle of over $1 million as it sees fit without any transparency or accounting.

According to the City of Austin's Annual Comprehensive Fiscal Reports, from 1991 through 2015, the PCTF generated a total of $2,222,126.00 in revenue. Yet from 2016 through 2023, the same reports allege that the PCTF earned not a penny of interest (copies of the balance sheets regarding the PCTF from 1992 through 2021 are here, while the documents for 2022 and 2023 are included at the end of this post). The United States Treasury states that average market yields on Treasury securities for the month of September 2023 was 5 3/8 percent. Although the interest rate does fluctuate daily, as of this posting, the interest rate on a one-year treasury bill was 5.21 percent. Assuming an interest rate of just 5 percent, if PARD had simply parked PCTF in a one-year treasury bill, there would have been potential revenues of $50,550.00 in just one year. Assuming the same interest rate over the past seven years, when PCTF supposably garnered no revenue, there would have been $353,850.00 in income that could have been used in accordance with local and state law. And this assumes that there were no additional grants to the PCTF; if the PCTF had been properly implemented in 1992 as set out by city ordinance, for over thirty years families could have contributed funds to the PCTF for the perpetual care of their loved ones' graves, but PARD has refused all such grants or gifts. I have been trying to donate $50,000 for the perpetual care of my parents' graves since 2017; assuming again that PARD had accepted my donation and simply used my grant to purchase a one-year treasury bill at an estimated 5 percent interest, that grant would have generated a total of $17,500.00 for maintaining my parents' gravesites, with any excess to go to the beautification of Austin Memorial Park (and considering that I and my family already maintain our family plots, it would be all excess at this point). Multiply this by the thousands of families who currently have gravesites in Austin's public cemeteries, as well as the several hundred burials that that take place annually, a competently and transparently run and well-publicized PCTF could potentially generate tens, if not hundreds, of dollars a year to maintain gravesites and cemeteries.

I bring this up because a recent story in The Austin Monitor reported that despite increases in Austin’s parkland acreage, on May 22, 2024, Austin City Council members discussed a report concluding that PARD provided a higher level of staffing and maintenance for the city parks in Fiscal Year 2014 than in Fiscal Year 2023. According to the article, council members expressed concern over the need to increase funding for the city parks. Unfortunately, Austin's cemeteries currently come under the jurisdiction of PARD, as if they were nothing more than a soccer field or swimming pool, ignoring their special cultural, historic, and emotional significance. Implementation of PCTF as enacted by the city in 1992 in accordance with state and city law would finally allow families to contribute to the perpetual care of their loved ones' final resting places and could potentially raise hundreds of thousands of additional funds to maintain and beautify Austin's cemeteries. However, considering PARD's opaque and illegal handling of finds currently in the PCTF, implementation must include clear, open, and transparent accounting of funds donated to the trust and the expenditure of any revenues, as well an intensive independent audit of the administration of the PCTF regarding all transactions, revenue, and expenditures since 1992.

Below are the balance sheets regarding the PCTF for Fiscal Years 2022 and 2023. From Fiscal Year 2018 on, the Annual Comprehensive Fiscal Reports also included the following page. Although the pretty little border may change, the wording stayed the same. The page describes the "Perpetual Care Fund" as "Accounts for revenues to be used for maintenance and care of cemeteries." There is no explanation that this is in fact a trust fund or why there are no "revenues." Nor is there any clarification that any revenue must be used only in accordance with state and local law, in that the funds must be expended for the maintenance of specified gravesites for which the principal funds were donated and then, only if there is any excess, may the revenue be used to maintain and care for the cemetery where that gravesite is located. The City's description of the PCTF is disingenuous and misleading.

* The reference is to the 1903 silent film, "The Great Train Robbery." However, at least in the film those crooks pilfering from the public were hunted down and punished.

No comments:

Post a Comment